Contents:

Justin Paolini helps traders succeed through 1-on-1 coaching at BuildingaTrader.com. He is also Head of Trader Development at FCI Markets UK. Justin has over 15 years of experience trading Forex of which 3 were spent as a Sales Trader and as a Broker. Previously, he was an analyst at 3CAnalysis.com, producing institutional grade directional calls. His market commentary has been published on FXRenew.com, Yahoo! Finanza, Trend Online, FX Street, OrderFlowtrading.com, and ForexTell.com.

Is GBP and EUR correlated?

In comparison, the GBP/USD and EUR/GBP have a strong negative correlation at -90, meaning they move in opposite directions much of the time.

There are plenty of strategies and techniques for working with the USD and Swiss franc. Let’s see how a trader can earn profit at Forex on the pair USD/CHF. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate.

The absence of effective correlation control can be a major source of risk in a forex strategy. The EURUSD and USDCHF currency pairs, for instance, typically move in opposing directions. There is a strong correlation between an upward trend in EURUSD and a downward trend in USDCHF. https://day-trading.info/ Therefore, purchasing position in both pairings would be self-defeat, potentially resulting in catastrophic losses. When you open two long positions in a positively correlated currency pair, the separate positions help you increase your profits as they move in your favour.

Calculating Correlations Yourself

As a result, the investors and traders might be less attracted to the lower-yielding Australian dollar and AUD/USD might fall significantly. Australia is a major producer of Gold, therefore it is not surprising that AUD/USD and XAU/USD have a notable connection. In fact, in the table above the Forex currency correlation indicator shows 0.76, which is significant. Well, not necessarily, the trader is not obligated to close those two trades at the same time. Let us say that after placing those trades, AUD/USD fell by 0.5% and USD/JPY has risen by the same percentage. If the direction of the market is clear, the trader can close losing the AUD/USD position, while keeping USD/JPY open.

Pound Sterling: Soft Markets and Bank of England Enforces Retreat against Euro and Dollar – Pound Sterling Live

Pound Sterling: Soft Markets and Bank of England Enforces Retreat against Euro and Dollar.

Posted: Fri, 03 Mar 2023 08:00:00 GMT [source]

There is a discrepancy between the trends of the pound and the Australian dollar, which began in the summer of 2013 and lasted about two years. Traders who entered the Forex market when an inverse correlation between the two pairs occurred could not calculate a deposit that could withstand the drawdown from such a difference in rates. It is clear from the above figure the EURUSD has dropped sharply, and we managed to close the position with the loss. However, the USDJPY price trend hasn’t changed; it continued running down.

Correlation coefficient formula

Conceptually, it’s easy to understand how deviation can measure volatility. The more the price of a currency pair fluctuates, the higher its deviation will be, and the less the price of a currency pair fluctuates, the lower its deviation will be. For example, the EUR/USD and GBP/USD both contain the US dollar, and the Eurozone and Great Britain are in close proximity with closely tied economies. Therefore, they tend to move together in the same direction, although this is not always the case, as we will see further on in the article. In fact, the Eurozone, Japan, Australia and the US all have distinct and separate economies. On the other hand, holding long EUR/USD and long AUD/USD or NZD/USD is similar to doubling up on the same position since the correlations are so strong.

For the year ending 2014, the UK ranked ninth globally in exports and fifth in imports. Trade with its EU partners represents a majority of the revenue generated in these sectors. EU members Germany, the Netherlands and France are three of the U.K.’s top four trade partners.

Changes in the economies, monetary policies, and political and social climates of individual countries can have large-scale effects on the correlations between different currency pairs. Correlations between different currencies can get stronger, weaker, or even completely random. Negative correlations indicate that the two currency pairs will tend to move in opposite directions.

The currency pairs with negative correlation can be just as useful as the examples mentioned above. In fact, sometimes they can be utilized as some sort of insurance policy against the potential losses. How to Use The Forex Arbitrage Trading StrategyForex arbitrage trading strategy allows you to profit from the difference in currency pair prices offered by different forex brokers. These two currency pairs are highly correlated because there is a very close relationship between the UK’s GBP and the European currency Euro. They are both one of the most vastly held reserve currencies, and their close geographic proximity and strong trade relations affect their economies almost the same way.

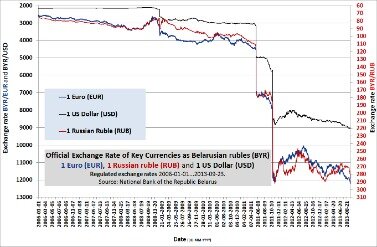

Comparative Chart

Therefore, as a trader, it is important to change your tact when trading during these periods of low volatility. Instead of focusing on the major currency pairs, you should reconsider looking at other new forex brokers, list of newest forex brokers reviews currencies. Also, you should consider other asset classes like commodities and energies. Correlation is a very important strategy that many traders and hedge funds have used to make profitable trades.

Spread is the difference between the two and is most narrow in normal market conditions. A wider spread is possible during the releases of economic data and the European night time. The most liquid currencies are the U.S. dollar , euro , British pound , Japanese yen , Swiss Franc and the Canadian Dollar . Using Forex the investor can hedge the currency risk by going long the EUR/USD. If the exchange rate goes down, the investor loses on Forex, but earns more on the produced goods. If an investor owns production facilities in Germany, and sells the produced goods in the U.S., he will benefit from the strengthening of U.S. dollar and the weakening of the euro.

- Pound sterling, for example, often sees a strong negative correlation to the FTSE 100.

- This information has been prepared by IG, a trading name of IG Markets Limited.

- His market commentary has been published on FXRenew.com, Yahoo! Finanza, Trend Online, FX Street, OrderFlowtrading.com, and ForexTell.com.

This is where traders might be tempted to trade positions that eventually cancel one another. A good example is on the EURUSD and USDCHF pairs which move in the opposite direction most of the time. When EURUSD is moving up, chances that USDCHF will be moving down are very high.Placing a buy position in the two pairs is therefore counterproductive and can lead to huge losses.

What moves currency pairs?

As a result, the cross hedge helped us reduce the risks and make profits simultaneously. Typically, correlation is used to confirm the correctness of the analysis. You can observe the behavior of a particular currency pair and, based on it, draw a conclusion regarding the currency pair correlating with it. The more trades move in the same direction, the higher the likelihood of establishing a new trend, which means that the chances of a successful trade Forex also increase. This way, you get additional confidence regarding simultaneous trades. You can find many websites that calculate the forex pairs correlation table.

One caveat to keep in mind is that Forex correlations are not stable over time. Correlations strengthen and weaken intermittently, even if the general tendency remains intact. For example, in the chart below we see a recent instance where EUR/USD and GBP/USD flipped to a weak inverse correlation during 2021. One currency pair’s price movement can be used as a forward indicator of the other’s when the two pairs are highly connected. Any sudden shift in one of the positively linked pairings will almost certainly be mirrored in the other. Therefore, if there is no relationship between currency pairs, then the behavior of both pairings will be entirely random and unrelated to the other.

Trade More and Get Paid

Discover the range of markets and learn how they work – with IG Academy’s online course. Stay informed with real-time market insights, actionable trade ideas and professional guidance. Choose from standard, commissions, or DMA to get the right pricing model to fit your trading style and strategy. Get started with your City Index account today – or try out trading with a free trading demo. When the US is in an inflationary period, the Federal Reserve raises interest rates.

Correlation is the ability of one trading instrument to repeat the directional movements of another instrument. The correlation of currency pairs is a phenomenon that occurs when the price movements of several currency pairs are similar. There is usually a stable relationship between the correlated pairs, and so, the use of a hedging strategy will be relatively safe. The key to a successful hedging strategy is that the currency correlations are not a constant value. You can take a position on currency correlations with financial derivatives such as CFDs and spread bets. To hedge your exposure, you put £8.50 per point of movement on USD/CHF and both currency pairs move 10 points.

75% of retail client accounts lose money when trading CFDs, with this investment provider. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. The price of the Canadian dollar is often positively correlated with the price of oil. Typically, an increase in the price of oil will see an increase in the value of the Canadian dollar on the forex market.

Currency pairs trade differently than equities and bonds for several reasons. For one, their volatility is not anchored to a set schedule, like it is for equities, bonds, commodities, and futures. Over the long run, the deviation of the USD/EUR will remain stable, even when the same amount of money is in play. Over the long run, the deviation of the EUR/GBP will remain stable, even when the same amount of money is in play.

Get full access to The FX Bootcamp Guide to Strategic and Tactical Forex Trading and 60K+ other titles, with a free 10-day trial of O’Reilly. There are many financial experts, who advocate for investments in Gold, Peter Schiff and Axel Merk are just two examples. How to Identify Cup and Handle Pattern in Forex TradingThe Cup and Handle Pattern is a technical price chart that forms the shape of a Cup and a Handle, which indicates a bullish reversal signal. How to Use The Alligator Indicator in Forex TradingThe Alligator indicator can identify market trends and determine ideal entry and exit points based on the trend’s strength.

The second reasons why you should use this strategy is to leverage on your profits. When using the strategy, you have a chance to double-up on positions which leads to maximized profits. He or she takes the advice of professionals in the field and only risks $500 (5% of the Funds) in every single trade. So the trader has opened long EUR/USD, GBP/USD, and short USD/JPY positions. AUD/USD vs USD/CHF is the last highly inversely correlated pair that ranges between -0.78 to -0.99 (-78% to -99%). The inverse relation between the two pairs is due to the US currency being in the quote currency place in the first currency pair and in the base currency place in the second one.

However, there are practically no trading tactics or investment research based on correlation. Commodity assets include everything that countries export and import. You have probably deduced that there is a strong correlation between the Canadian dollar and oil. A correlation is also observed between the Australian dollar and gold. Very often, trading commodities means trading CFDs rather than physical assets.

What is Eurusd correlated with?

For example, EUR/USD and GBP/USD are often positively correlated because of the close relationship between the euro and the British pound – including their geographic proximity, and their status as two of the world's most widely-held reserve currencies.

The forex market is the largest financial market globally by a significant margin, with more than $5 trillion changing hands each day. Global currencies are traded on several exchanges, each with its own daily trade volume. Economic indicators like interest rates and Gross Domestic Product help predict the future direction of a currency pair.

Is GBP and EUR correlated?

In comparison, the GBP/USD and EUR/GBP have a strong negative correlation at -90, meaning they move in opposite directions much of the time.